Recebido: 03-01-2023 | Aprovado: 16-02-2023

![]() Ahmed Hrifa, École Nationale de Commerce et de Gestion de Settat, Maroc (ahmedhrifa00@gmail.com)

Ahmed Hrifa, École Nationale de Commerce et de Gestion de Settat, Maroc (ahmedhrifa00@gmail.com)

How to Cite:

Hrifa, A. (2023). Essays on the measurement of pressure on the foreign exchange market in Morocco.

[RMd] RevistaMultidisciplinar, 5(1), 181–197.

https://doi.org/10.23882/rmd.23127

Abstract: This article aims to measure the pressure on the Moroccan foreign exchange market through the Exchange Market Pressure Index (EMPI). It was found that no crisis was reported by this index during the years: 2018 & 2019, which means that the policy of gradual flexibility of the exchange rate regime, which entered into force in January 2018, played a significant role in this sense. Therefore, this reform would certainly have reduced the pressure on the exchange rate by mak-ing the Moroccan economy more resistant to exogenous shocks. So, 8 periods of crisis were identified with significantly high probabilities. Into these 8 periods, we can distinguish 3 periods that were predicted with more intensity, specifically in the second half of 2008, in the first half of 2012 & in 2017.

Keywords: exchange rate, foreign exchange market, EMP index, pressure, Morocco.

Introduction

Since the collapse of the Bretton Woods system in the early 1970s, discussions on exchange rates and the consequences of their risks on economies have not ceased. Indeed, several systemic financial crises have affected the world, especially the Mexican peso crisis (1994-1995), the Asian crisis (1997), the mortgage crisis in the USA (2007-2008) and currently the Covid-19 crisis. This is how global finan-cial markets have become more unstable and volatile, leading to more recurrent and deeper crisis scenarios (Ilzetzki, E., Reinhart, C. M., and Rogoff, K. S., 2019).

Currency crises seem to be becoming a crucial theme in financial systems today, both nationally and internationally. Many studies have been conducted to meas-ure the pressure on the foreign exchange market and to identify speculative at-tacks on local currencies. In this context, the International Monetary Fund (IMF, as a supervisor and regulator of the world economy, defines speculative attacks as a kind of exchange rate crisis that occurs when the national currency devalues (system with a fixed exchange rate), depreciates (system with a flexible exchange rate) or is at a level far from its equilibrium value. In this case, the monetary au-thorities are forced to significantly increase interest rates or inject large volumes of foreign currency into the foreign exchange market to protect the national cur-rency. For this reason, the IMF has developed an early warning system for for-eign exchange crises which includes formal and quantitative tools, including in particular the Exchange Market Pressure Index (EMPI). This index allows the authorities to provide an appropriate response to correct the pressures on the for-eign exchange market. In other words, this index measures the change in ex-change rate that would have taken place had the central bank not intervened (M. Desai, I. Patnaik, J. Felman & A. Shah, 2017). If currency crises are a phenome-non to be reckoned with, it is necessary to know the mechanisms by which shocks are transmitted from the real economy to the currency, hence the notion of pres-sure on the exchange rate. Indeed, currency crises appear following pressure on the exchange rate. How then to measure the degree of pressure on the Moroc-can foreign exchange market?

Based on several theories, including Purchasing Power Parity (PPP) theory, signal theory and currency hedging theory, the objective of this paper is to measure the pressure on the dirham, the official currency of the Kingdom of Morocco, and also to identify periods of high tension on the foreign exchange market, over a period from January 2002 to December 2019, through the use of the EMP Index, developed by Girton and Roper. This article is structured around three sections. The first section of this work consists of establishing a brief literature review. The second section will focus on presenting the methodological choices we made to validate the research hypotheses. Finally, the last section is devoted to the presentation of the estimation results, on the one hand of the probability of trig-gering a foreign exchange crisis in Morocco, and on the other hand, of future periods of pressure on the foreign exchange market in Morocco.

1. Literature review

The currency crisis is present when the exchange rate has

depreciated significantly over a short period. Eichengreen et al. (1994)define speculative attacks or crises

as large movements in exchange rates, interest rates and international reserves.

Frankel and Rose (1996) explain that a devaluation of at least 25% in nominal

value and a decrease of 10% compared to the previous year leads to a crushing of

the currency. The models of the literature on the monetary crisis are called:

first, second or third generation. The Krugman (1979) and Flood and Garber

(1984) models are the main studies of the first generation models. The main

components of a first-generation model are PPP, budget constraints, timing of

deficits, money demand function, government decision on exchange rate, and

post-crisis monetary policy. Second generation models often include more

speculative attack factors arising due to self-fulfilling expectations

((Obstfeld, (1994), Obstfeld (1997), Velasco, (1996))Market

participants believe in the The ultimate failure of policy makers to defend the

exchange rate can be costly due to high interest rates.Third-generation models

emphasize devaluation-adjusted balance sheet decompositions. The speculative

pressure index (Eichengreen, Rose and Wyplosz, 1996), the currency market

turbulence index (Kaminsky & Reinhart, 1999), the banking sector fragility index

(Kibritçioğlu, 2003) and the index extreme risk (Ural and Balaylar, 2007)were formed according to the signal approach to measure the degree

of pressure on the financial markets and predict crises. Eichengreen et al.

(1994) suggest the foreign exchange market confidence index formulated by the

weighted average of changes in exchange rates, official reserves and interest

rates. Crisis is defined as the multiple of the standard deviation above the

sample mean, i.e. the EMPI reaches an extreme value. The sample mean and

baseline standard deviation can also be differentiated across countries.

According to the signal approach, a variable is believed to give a

warning signal that a crisis may occur if the variable exceeds a certain

threshold in the period preceding a crisis. Kaminsky et al. (1998) pioneered

this approach. Leading indicators are divided into variables. The next step in

finding early warning indicators is to study the behavior of the variables.

Exports overvalued real effective exchange rates (REER), slowing GDP growth,

high ratio of money (M2) to foreign exchange reserves and equity prices give

reliable signals that a crisis of change may occur in the next twenty-four

months when these variables exceed limit values. Muhammad Aftab & Kate

Phylasktis (2022) have examined the influence of economic integration, both real

and financial, on EMP, along with considering external monetary and economic

policy uncertainties. Their analysis is based on a group of Asian emerging

markets over the period 2000- 2018, which covers the global financial crisis and

taper tantrum episodes, which have heightened monetary and economic policy

uncertainty. By bringing improvements in modeling, and EMP measurement, a time

series analysis shows an overall buffering role of real and financial

integration on EMP, albeit with a country-level heterogeneity. Similarly, there

is country-level heterogeneity in the foreign exchange market response to

monetary and economic policy uncertainties with surging effects in most cases.

Indeed, Devendra Kumar Jain & al. (2023) show that China and Russia exchange

market pressure has a negative effect on the exchange market pressure of CAEs.

While the dollar index shows a positive impact on the exchange market pressure

of CAEs.

Researchers are always interested in predicting the timing and form

of monetary crises, in this regard there are many studies in the literature.

These studies are divided into two groups.

The first group includes studies that propose both parametric

(regression-based) and non-parametric (early signal) models and evaluate the

performance of the different signal approach. Signal approach studies are

frequently applied in the literature. Girton and Roper (1977) create the foreign

exchange market pressure index using monetary policy and balance of payments.

Weymark (1995) provides a theoretical background for the Girton and Roper model.

Eichengreen et al. (1994) form the Exchange Market Preassure Index using the

signal approach. This study was the pioneer of another research. Using the

logitprobit model, Frankel and Rose (1996) examine 70 crises with 17 leading

indicators over 105 developing countries over the period (1971-1992). Kaminsky,

Lizondo and Reinhart (1998) observe indicators showing unusual behavior before

the financial crisis. Bussiere and Fratzscher (2006) developed an

early warning system based on multinomial logit regression that allows to

differentiate calm periods, crisis periods and post-crisis periods. The

multinational logit model tends to predict the financial crisis in emerging

markets better than the binomial logit model. Beckman et al. (2006) apply

parametric and non-parametric early warning systems on a sample of 20 countries

between January 1970 and April 1995. Comelli (2014) also compares the

performance of parametric and non-parametric early warning systems for currency

crises in 28 emerging countries and observes that parametric systems have better

results.

The second group of studies on early warning systems consists of a

discussion of the importance of leading indicators or macroeconomic indicators

in explaining the crisis. Corsetti and. al (1998) note that the Asian crisis is

the result of weak macroeconomic fundamentals and a weak institutional

environment. Yorgancılar and Soydal (2016), Uğurlu and Aksoy (2017) and Kaya and

Köksal (2018), study the relationship between the foreign exchange market

pressure index and macroeconomic indicators in Turkey. Uğurlu and Aksoy (2017)

observe a relationship between current account deficit, interest rate, total

liabilities and volatility index (VIX). Similarly, Yorgancılar and Soydal (2016)

conclude that the Lending/National Income Rate and the VIX index are significant

on the FX market pressure index. Also, Kaya and Köksal (2018) show

unidirectional Granger causality from the stock market to the foreign exchange

market pressure index using the vector auto regression analysis model.

From this literature review, we can understand that a high degree of

dependence on imports exposes a country to pressure on exchange rates, because

its foreign exchange reserves can quickly run out. The inclusion of foreign

exchange reserves in the EMPI aims to capture episodes of speculative pressure

causing the central bank to intervene in the spot foreign exchange market to

defend its currency. Thus, we can formulate the following first hypothesis:

H3: There is a positive relationship between the change in exports

and the EMP Index

Given the diversity of exchange rate regimes, and the different reactions to the shock, the EMPI, developed by Girton and Roper, is used to quantify the pres-sures on a currency. This indicator is relevant whether the plan is fixed, interme-diate or flexible. The EMPI is calculated monthly, it can be positive or negative. A higher EMPI, reflecting the depreciation and/or depletion of reserves, thus in-dicates heightened tensions in the foreign exchange market. The objective is to identify episodes of currency crises in the Moroccan economy. To do this, we construct an EMPI, using monthly data relating to the nominal exchange rate against the dollar and foreign exchange reserves. This index will be used in the section devoted to measuring the responses of business sectors to exchange rate risks. Indeed, we can calculate the EMPI as follows:

![]()

Either:

![]()

Where:

![]() is the change in the

nominal exchange rate against the dollar at time t,

is the change in the

nominal exchange rate against the dollar at time t, ![]() is the change in the

stock of foreign exchange reserves at time t,

is the change in the

stock of foreign exchange reserves at time t, ![]() represents the ratio

between the standard deviations of variations in the nominal exchange rate

against the dollar and the stock of foreign exchange reserves.

represents the ratio

between the standard deviations of variations in the nominal exchange rate

against the dollar and the stock of foreign exchange reserves.

Remember that the EMPI is a weighted average of variations in the nominal exchange rate and foreign exchange reserves. The higher the EMPI, the greater the pressure on currency demand. In addition, a country is exposed to a speculative attack when the EMPI exceeds a certain threshold that we will define later. Once the EMPI is calculated, it is needed its mean (μ EMP) and its standard deviation (σ EMP). Admittedly, a given economy is exposed to a speculative attack when the EMPI reaches twice the deviation from its average (which can be called a critical threshold).

Technically speaking, there is a crisis if: • If EMPI t > μ EMPI + φ* σ EMPI with φ is a parameter fixed at 2 (for our case), in accordance with what is done in the literature and it generally assumes values between 1.5 and 3. Taking into consideration the conceptual underpinnings relating to the EMPI and in order to estimate it for the case of our country, we will use monthly data, ranging from January 2002 to February 2020, relating to the nominal exchange rate and to the reserves of exchange. Subsequently, a second crisis index is calculated as a binary variable taking the following values:

- 1 when the first index reaches the critical threshold ( EMPt > μ EMP + φ* σ EMP )

- and 0 elsewhere.

3. Empirical Results

3.1. Analysis of the evolution of the EMPI in Morocco

EMP indices are weighted and scaled sums of exchange rate depreciation, official foreign exchange intervention, and policy rate changes (Linda Goldberg & Signe Krogstrup, 2023).The analysis of the evolution of the EMPI through a graphic representation makes it possible to identify the different phases of crises over the above-mentioned period. Particular attention will be given to the last two years which have seen the introduction by Morocco of a more flexible exchange rate regime.

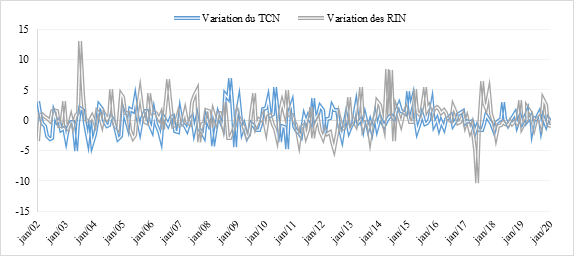

Figure 1: Evolution of variations in the nominal exchange rate and foreign exchange reserves in Morocco between 2002 and 2020

It is clear that foreign exchange reserves have been considerably reconstitut-ed in the Moroccan economy since the entry into force of the reform of the ex-change rate regime towards a more flexible regime. Indeed, they were of the or-der of 241 MM.DH at the end of December 2017 to rise thereafter on April 17, 2020 to 286.3 MM.DH. This notable improvement is naturally the result of Mo-rocco's successful exit from the international financial market, which was con-cluded with the signing of a bond loan in the amount of 1 billion euros in No-vember 2019, and the drawing on the Precautionary and Liquidity Line (PLL) of 3 MM dollars with the IMF in April 2020.

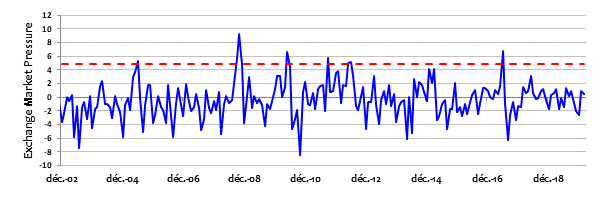

Figure 2: Evolution of the EMPI crisis index in Morocco between 2002 and 2020

Source: Elaborated by

the author

The analysis of the monthly evolution of the EMPI, during the period Janu-ary 2002-April 2020, made it possible to identify 6 periods marked by pressure on the Moroccan foreign exchange market:

Table 1: Periods marked by pressure on the foreign exchange market in Morocco between 2002-2020

|

Periods |

Interpretations |

|

1st _ period (June 2005) |

This period was characterized by a 3.5% depreciation of the dirham

against the dollar and a 2.4% drop in foreign exchange reserves in the

month of April 2005 alone. |

|

2nd period (September-October 2008) |

This period coincided with the advent of the international financial

crisis, the value of the dirham recorded an average depreciation of more

than 4% and foreign exchange reserves contracted by 6%, from 200 MM.DH

in August 2008 to 189 MM.DH in October 2008. |

|

3rd period (May 2010) |

This period saw a 4.8% depreciation of the NEER and a 5% drop in foreign

exchange reserves. |

|

4th _ period (September 2011)

|

The pressure is induced in particular by the effect of the 3% drop in

foreign exchange reserves and a 4% depreciation of the dirham against

the dollar. |

|

5th _ period (May- June 2012)

|

During this period, the value of the dirham depreciated by more than 2%

and foreign exchange reserves registered a cumulative drop of nearly 8%. |

|

6th _ period (May- June 2017)

|

This period is characterized by the effects of the announcement by the

Moroccan authorities of their intention to switch to a more flexible

exchange rate regime. Consequently, the dirham was put under pressure

under the effect of fears expressed by banks and importers who sought to

protect themselves against a possible depreciation of the exchange rate. |

Source: Elaborated by the author

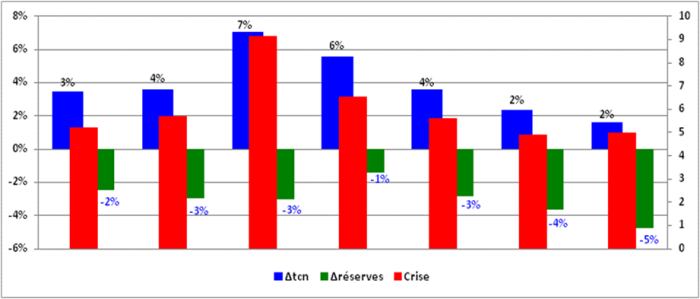

Considering the results of the previous analysis, it can be concluded that the EMPI recorded particularly significant increases during the years 2002, 2006, 2008, 2011 and 2017. These years correspond to periods when Morocco experi-enced crises of which coincided with significant fluctuations in both Net Interna-tional Reserves (significant drop in NIR ) and the Nominal Exchange Rate (strong appreciation of the TCN). In the same vein, the main crisis experienced by Morocco according to the EMPI is that of October 2008, when the dirham was devalued by 7%. Similarly, foreign currency reserves decreased by 6% from 200 MM.DH in August 2008 to 189 MM.DH in October 2008. Obviously, it seems that the combined effect of an appreciation of the TCN and a significant drop in the RIN makes the Moroccan economy particularly vulnerable to a currency cri-sis. The figure below groups together a few scenarios to avoid in order to prevent the appearance of a possible crisis or pressure on the foreign exchange market.

Figure 3: Scenarios that may cause pressure on the foreign exchange market in Morocco

Source: Calculated and elaborated by the author

Starting from the fact that no crisis has been signaled by the EMPI index during the last two years, it can be concluded that the policy of gradual flexibility of the exchange rate regime, which came into force in January 2018, played a crucial role in that Sens. Consequently, this reform would undoubtedly have reduced the pressure on the exchange rate by making the Moroccan economy more resilient and less vulnerable to external shocks.

3.2 Estimation of the probability of triggering a currency crisis

In order to assess the probability of occurrence of a currency crisis on the

foreign exchange market in Morocco, we based ourselves on the Logit model (of

which "CRISIS" is the binary variable explained)[1]

, which takes into account the explanatory variables of Morocco's external

sector. The objective is to empirically identify warning indicators that can

signal as faithfully as possible the probable occurrence of a currency crisis.

It is a question of defining the factors of vulnerabilities to exchange rate

crises, beyond the determinants of the exchange market, by integrating other

explanatory variables linked to the external sector. The model Logit defines the

probability associated with the event y= 1 (crisis) as the value of the

distribution function of the logistic law at the point

![]()

![]()

It admits as distribution and density functions respectively:

![]() &

&

![]()

Where

In order to model the "CRISIS" variable for the case of Morocco, we will use

quarterly data covering the period starting from (Q1-2001 to Q4-2019)[2]

. We have retained, in accordance with the various studies cited in the

empirical literature, certain key variables of the external sector, in this

case:

• The change in foreign exchange reserves (VAR_RIN);

Table N°2: The outputs of the Logit model

Variable

Coefficient

Std . error

z- Statistic

prob .

VAR_EXP (-1)

-0.15

0.06

-2.31

0.0209*

VAR_RIN ( -1)

-0.34

0.11

-3.27

0.0011*

MES_ REER( -1)

-0.09

0.11

-0.86

0.3890*

CC_BOP ( -1)

0.33

0.09

3.58

0.0003

Source: BAM, calculated by the author; *Significant at the 5% threshold

The results of the Logit model shown in the table above show the expected impact

of the warning variables used on the crisis index. Thereby :

3.3. Periods of future pressure on the Moroccan foreign exchange market

On the basis of the previous results, we see that the increase in the frequency

of occurrence of a currency crisis is attributable to the deterioration of the

main indicators of the external sector, apart from the variation in exports.

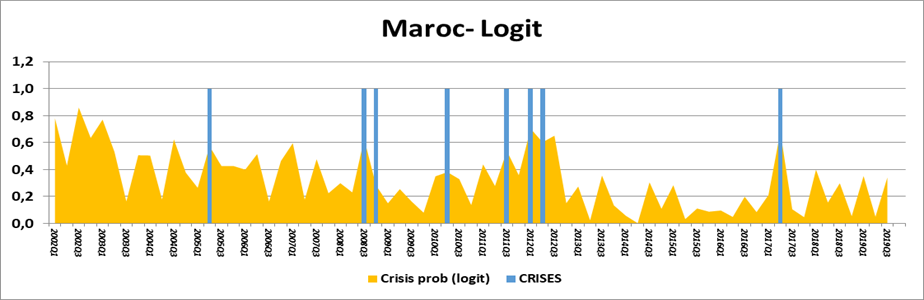

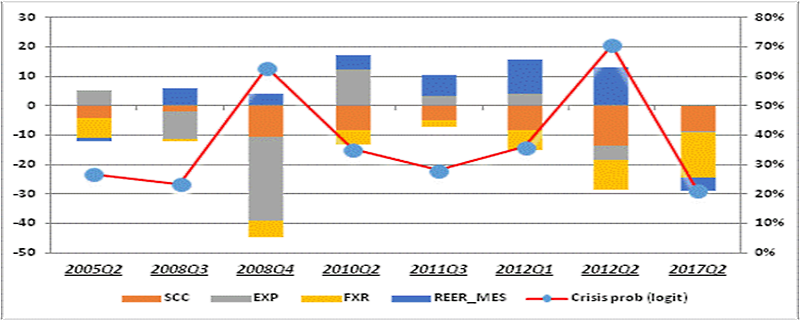

Figure 4: Probability of crisis according to logistic regression with lagged exogenous variables

Source: compiled by the author

The Logit model predicted 8 crisis periods with significantly high

probabili-ties. Among these 8 periods, we can distinguish 3 periods which were

planned with more intensity, in particular in the second half of 2008, in the

first half of 2012 and in the second quarter of 2017.The analysis of the graph

above shows us that after the first exchange rate crisis recorded on the foreign

exchange market in the first quarter of 2002, the rate of appearance of crises

accelerated between 2008 and 2012 following in particular to the effects of the

2008 financial crisis. the external sector during this period.

Figure 5: Contributions of external fundamentals in triggering crises

Source: calculated and elaborated by the author

In other words, the Moroccan foreign exchange market was under pressure in the

fourth quarter of 2008, with a probability of crisis approaching 63%. This

unfavorable situation is mainly due to the worsening of the current account

defi-cit by 10.7%, the drop in exports by 28% and the drop in foreign exchange

re-serves by 6%. As for the crises of the first and second quarters of 2012,

they are explained by the record levels of the current account deficit of -8.3%

and -13.5% respectively, the sharp drop in reserves of -7% and -10 %

respectively and the overvaluation of the REER by 12% and 13%. As for the crisis

reported in the second quarter of 2017, it stems from a deterioration in the

current account bal-ance deficit (-9%), the drastic drop in reserves (-16%) and

the depreciation of the dirham by more than 4%. The main conclusion of this

analysis is that the EMPI index did not signal any currency crises during the

years 2018 and 2019. It is therefore clear that the reform of the exchange rate

regime towards a more flexi-ble exchange rate, entered into in force at the

beginning of 2018, contributed significantly to moderating the extent of the

pressures on the foreign exchange market and to making the Moroccan economy

relatively more resilient to exter-nal shocks.

The national project relating to the design of a new development model, showing

some delay due to the national and international situation surrounded by

uncertainties, constitutes an important opportunity for decision-makers to

address issues relating to the external sector, and more particularly the

foreign exchange market, and their repercussions on the macroeconomic framework.

History shows us that experiences differ and that what worked for one country in

one context and time may not work in another country. We can always learn from

the experi-ences of others, but to succeed an effort of adaptation is strongly

required. This effort must imperatively take into account the various

constraints of the current situation imposed in particular by the globalization

of trade and international competition which, day by day, is becoming more and

more severe by relying on our competitive advantages in economic, institutional,

political and cultural.

Conclusion & policy implications

As a conclusion, the measurement of the pressure on the Moroccan foreign

exchange market through the EMPI index has allowed us to observe that this

in-dex recorded particularly significant increases during the years 2002, 2006,

2008, 2011 and 2017. These years correspond to periods when Morocco experienced

currency crises that coincided with significant fluctuations in both Net

Interna-tional Reserves (significant decline in NIR) and the Nominal Exchange

Rate (strong appreciation of the NCR). In the same vein, the main crisis

experienced by Morocco according to the EMPI is that of October 2008, when the

dirham was devalued by 7%. Obviously, it seems that the combined effect of an

appreciation of the TCN and a significant drop in the RIN makes the Moroccan

economy par-ticularly vulnerable to a currency crisis. Starting from the fact

that no crisis was signaled by the EMPI index during the years 2018 and 2019, we

can conclude that the policy of gradual flexibility of the exchange rate regime,

which came into force in January 2018, played a crucial role. in this direction.

Consequently, this reform would undoubtedly have reduced the pressure on the

exchange rate by making the Moroccan economy more resilient and less vulnerable

to external shocks. Thus, 8 periods of crisis were identified with significantly

high probabili-ties. Among these 8 periods, we can distinguish 3 periods which

were planned with more intensity, in particular in the second half of 2008, in

the first half of 2012 and in the second quarter of 2017. In short, there are

still many questions relating to the measurement of pressure on the foreign

exchange market. The theoretical and managerial issues are also important, which

gives rise to many future research works and offers a favorable field for the

development of scien-tific research.

References

[1] The Logit model was introduced by Joseph

Berkson in 1944. It is a probabilistic econometric model which is used to model

the probability of observing an event conditional on the exogenous variables

“y= 1; crisis” as the value of the distribution function of the logistic law at

the point [2] Data relating to

the exchange rate and international reserves are taken from the Bank Al Maghrib

financial statistics database. For variables relating to the external sector

such as exports and the current account balance of the balance of payments, we

use data provided by the Office des Changes.![]() for all

for all ![]() is: l

is: l ![]() and

and ![]() corresponds to the vector

of parameters.

corresponds to the vector

of parameters.

• The current account deficit as a percentage of GDP (CC_BOP);

• The misalignment of the TCER (MES_TCER);

• The variation in exports (VAR_EXP).

◾ While putting pressure on the foreign exchange market, REER

distortions increase the likelihood of a foreign exchange crisis. Consequently,

the Moroccan economy is all the more vulnerable to a currency crisis if the

value of the dirham is under/or overvalued.

◾ Regarding the current account deficit of the balance of

payments, a wid-ening of the latter can be seen as a sign of vulnerability and

can also contribute to an increase in the EMPI. According to the estimates

obtained, the Logit model reveals that a significant worsening of the current

account deficit during period t-1 tends to increase the probability of a

currency crisis appearing during period t.

◾ With regard to exports, any improvement in these could reduce a

coun-try's vulnerability to a currency crisis. In our case, it seems that the

increase in Moroccan exports seems to have a weak or even zero impact (0.2%) on

the EM-PI. In this respect, one could conclude that the variation of exports

cannot be considered as an early warning indicator to predict the pressures on

the foreign exchange market in Morocco.

◾ As for the impact of the latest warning indicator, the change in

foreign exchange reserves, it seems that a delayed improvement in the latter, by

just one quarter, would be enough to have a positive impact on the EMPI. This

variable thus plays a decisive role in the stability of the foreign exchange

market by re-ducing Morocco's vulnerability to a crisis on this market.

Bussiere, M., & Fratzscher, M. (2006). Towards a new

early warning system of financial crises. Journal of International Money and

Finance, 25(6), 953-973.

https://doi.org/10.1016/j.jimonfin.2006.07.007

![]() :

: ![]() .

.